Calculating Child Support in New York

A definitive guide to the Child Support Standards Act (CSSA), Pendente Lite support, and navigating the courts.

Child support is not a punishment for one parent or a reward for the other; under New York law, it is the fundamental right of the child to be supported by their parents. Whether you are in Supreme Court for a divorce or in Family Court for a support petition, the math used to determine the obligation is strict, statutory, and largely unavoidable.

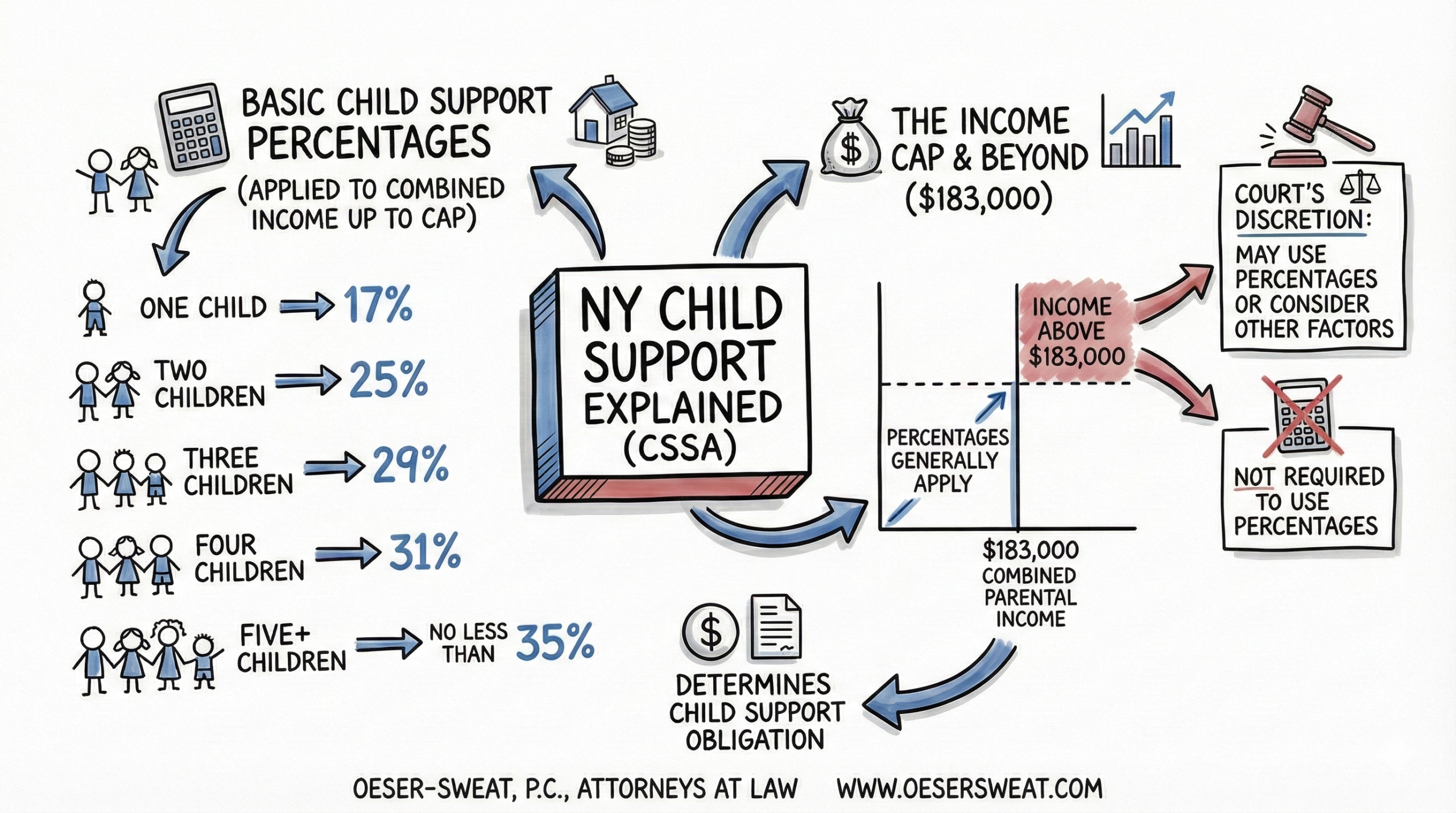

View Text Description of Graphic

1. Calculate Income: Determine gross income for both parents as reported on the most recent tax return.

2. Deductions: Subtract mandatory deductions like FICA (Social Security/Medicare) and NYC/Yonkers local taxes. This results in Adjusted Gross Income.

3. Combined Income: Add both parents’ Adjusted Gross Incomes together.

4. Apply Percentage: Multiply the combined income by the statutory percentage: 17% (1 child), 25% (2), 29% (3), 31% (4), 35%+ (5 or more).

5. Pro Rata Share: Divide the total obligation between parents based on their specific contribution to the total combined income.

1. The Formula: Child Support Standards Act (CSSA)

New York does not guess at child support numbers. It uses a rigid formula known as the CSSA. The court looks at the “Combined Parental Income” and applies a percentage based on how many children you have:

- 1 Child: 17% of combined parental income

- 2 Children: 25% of combined parental income

- 3 Children: 29% of combined parental income

- 4 Children: 31% of combined parental income

- 5 or More: No less than 35%

This percentage applies to the combined income up to a statutory cap (which adjusts annually, currently approx. $183,000 as of 2024). For income over that cap, the court has the discretion to apply the same percentage or use a different calculation based on the “Paragraph F” factors (standard of living, special needs, etc.).

2. The “Add-Ons”: It’s Not Just the Base Check

The monthly check calculated by the percentage above is the “Basic Child Support Obligation.” However, parents can also be responsible for mandatory “add-ons” which are split pro-rata (based on who earns more). These include:

- Health Insurance: The cost of premiums to cover the child.

- Unreimbursed Medical: Co-pays, dental, and optical costs not covered by insurance.

- Child Care: Costs incurred so a parent can work or attend school.

- Education: In some cases, private school or tutoring costs.

3. Supreme Court vs. Family Court

Where you file depends on your marital status and the stage of your case.

Supreme Court (The Divorce Forum)

If you are getting divorced, child support is handled as part of the matrimonial action in Supreme Court. You do not need to go to a separate building. In fact, if a divorce is pending, Family Court generally cannot touch support issues unless the Supreme Court refers it there.

Divorces can take years. Likely, you cannot wait until the trial is over to feed your children or pay tuition. In Supreme Court, a parent can file a Motion for Pendente Lite Relief (temporary support).

To succeed on this motion, you must submit a detailed Statement of Net Worth, current pay stubs, and tax returns. The court uses the CSSA guidelines to calculate temporary support immediately. This “temporary” order often sets the tone for the final settlement, so it must be taken seriously.

Family Court

If you are not married, or if your divorce is already finished and you need to modify the order, you go to Family Court. Here, a “Support Magistrate” (not a Judge) usually hears the case. The process begins by filing a Petition. If you fail to appear for a hearing, a default judgment can be entered against you.

4. What Needs to Be Shown?

To get a court to set support, you do not need to prove the other parent is “bad.” Many times you only need to prove:

- The legal parent-child relationship exists.

- The child is under 21 (New York’s age of emancipation for support).

- The financial income of both parties.

Warning on “Hidden” Income: If a parent claims they have no income but lives a lavish lifestyle, the court can “impute” income to them—basically pretending they earn what they should be earning based on their education and past employment history.