Choosing the Right Entity for Your NY Business

A strategic comparison of LLCs, Corporations, and Sole Proprietorships for New York entrepreneurs.

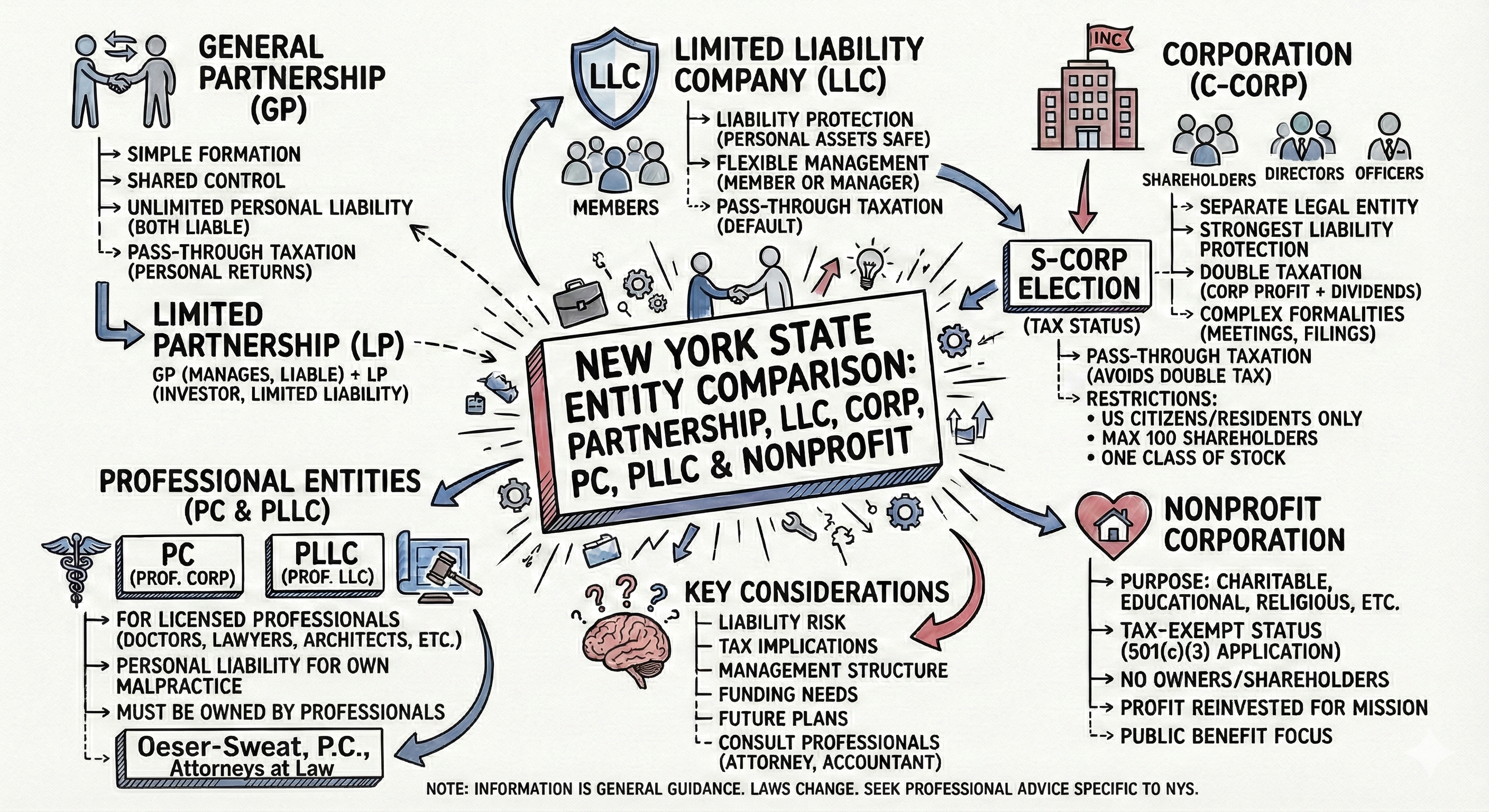

One of the first and most critical decisions you will make as a founder in New York is selecting the legal structure of your business. This choice affects everything from your personal liability and tax obligations to your ability to raise capital.

View Text Description of Entity Chart

Sole Proprietorship: The simplest form. No liability protection (personal assets are at risk). Taxes are filed on personal returns. No state filing is required to exist, though a DBA is needed for trade names.

General Partnership: Similar to a Sole Prop but for two or more people. Partners share unlimited personal liability for business debts. A Partnership Agreement is highly recommended but not filed with the state.

Limited Liability Company (LLC): Offers personal liability protection. Taxes are “pass-through” (avoiding corporate tax) unless elected otherwise. Requires filing “Articles of Organization” and meeting New York’s Publication Requirement.

Corporation (Inc.): A formal separate legal entity. Offers strong liability protection. Owned by shareholders and managed by a Board. “C-Corps” face double taxation, while “S-Corps” (if eligible) allow pass-through taxation.

1. Sole Proprietorship: The Default Option

If you start doing business today without filing any paperwork, you are a Sole Proprietor. While this is the easiest and cheapest way to start, it carries the highest risk. In a Sole Proprietorship, there is no legal distinction between you and the business. If the business is sued, your personal house, car, and savings are at risk.

2. Limited Liability Company (LLC): The Modern Standard

For most small businesses in New York, the LLC is the preferred vehicle. It provides a “corporate veil” that protects your personal assets from business liabilities, much like a corporation, but offers the tax flexibility of a partnership.

The NY Publication Requirement: Unique to New York, newly formed LLCs must publish a copy of their Articles of Organization in two newspapers for six consecutive weeks. This can be a surprising expense for new founders, particularly in New York City.

3. The Corporation: Built for Scale

If you plan to raise venture capital or go public, a Corporation (C-Corp) is usually the required structure. Investors prefer the formal share structure of a corporation. However, C-Corps face “double taxation”—the company pays tax on profits, and shareholders pay tax on dividends.

The S-Corp Election

Many small corporations (and LLCs) elect “S-Corp” status with the IRS. This allows the business to be taxed like a partnership (pass-through), avoiding double taxation, while maintaining the formal structure of a corporation. Strict eligibility rules apply.

4. Naming & Compliance

Before falling in love with a brand name, you must check its availability. You cannot use a name that is “confusingly similar” to an existing entity. Use the state’s database as well as the USPTO’s Trademark database to research your potential name before spending money on marketing.